Government Assures Public of Smooth Transition to New Property Tax Regime and Prompt Addressal of Grievances

By KS Correspondent

The Government of Jammu & Kashmir has announced the imposition of property tax throughout the region, effective from April 1st, 2023. This announcement has caused a stir amongst the public, with various factually incorrect and misleading pieces of information being circulated through the media, potentially leading to confusion and misguided decision-making.

The government has issued a statement urging the public to remain vigilant and not fall for any misleading information regarding the new tax. The government emphasizes that it is essential for the public to have access to accurate and comprehensive information, which will enable them to make informed decisions regarding the tax.

According to official sources, the new property tax will be imposed on all types of property, including residential, commercial, and industrial properties. The tax will be based on the market value of the property and is expected to be a significant source of revenue for the government.

This announcement has led to a mixed response from the public, with some welcoming the move as a necessary measure to generate revenue for the region, while others have expressed concerns over the potential impact on their financial stability.

In light of the confusion and misinformation surrounding the new tax, the government has announced that it will be launching a comprehensive awareness campaign to ensure that the public is aware of all the facts and implications of the new tax. The campaign is expected to include detailed information about the tax, its scope, and exemptions, along with other relevant details.

The government has also assured the public that all necessary measures will be taken to ensure a smooth transition to the new tax regime and that any concerns or grievances regarding the tax will be addressed promptly.

Overall, the imposition of the property tax in Jammu & Kashmir is a significant development that has the potential to impact the lives and finances of millions of people. It is essential that the public is aware of all the relevant facts and information and that they make informed decisions regarding the tax.

Property tax is a globally accepted means for municipalities to generate revenue. In a surprising revelation, Jammu & Kashmir was the only State/UT in the country without this tax. This has led to poor finances and limited resources for the Urban Local Bodies (ULBs) across the region, resulting in inadequate service delivery. According to official sources, the revenue generated from other sources accounted for less than 15% of their operational expenses. With limited funds for development, the government felt it was necessary to impose the property tax. This move is aimed at breaking the cycle of low revenue and low service levels that have plagued the region. Therefore, the government sees no compelling reason for not imposing the property tax in Jammu & Kashmir, which will help generate much-needed revenue for the development of the region.

A robust and effective system of local self-government is crucial for the successful functioning of a democracy. To enable such a system, it is essential to have adequate finances at the disposal of the institutions of self-government, and the more these finances are mobilized at the local level, the better their effective functioning. Property tax is one of the essential pillars of municipal financing across the world. The Government of India, along with its Finance Commissions, has been recommending the tapping of this resource for some time now. Against this backdrop and with the intent of strengthening our Urban Local Bodies (ULBs) and enhancing urban development for the betterment of the masses, the Government of Jammu and Kashmir has announced the imposition of property tax in the Union Territory. The government recognizes that development is impossible without adequate resources and sees the property tax as a means of augmenting its resources to enable the much-needed development of the region.

There have been concerns raised about the possibility of the government taking away the monies collected through the recently announced property tax in Jammu and Kashmir. However, government officials have strongly refuted such claims and have assured the public that the monies collected will be retained by the Urban Local Bodies (ULBs) and used for their development needs. The ULBs will have complete control over the collected funds and will ensure that they are utilized for the betterment of the people in the region. The government sees this tax as a means of generating revenue to enhance the quality of life of the masses and to promote their overall well-being. Hence, there is no need for apprehension as the government has a clear policy of utilizing the funds collected through taxes for the welfare of the public.

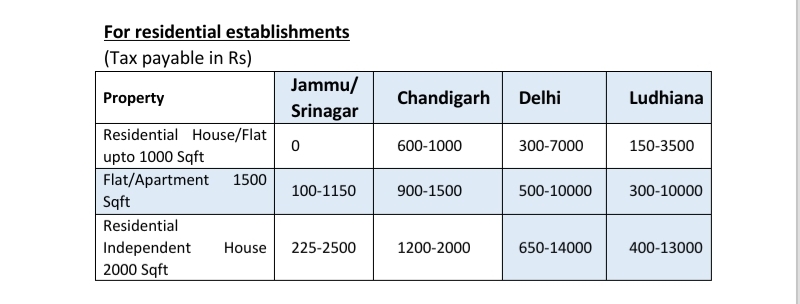

The recently proposed property tax in Jammu and Kashmir has caused some concerns among the public regarding the tax rates. However, government officials have clarified that the tax rates are not high and are actually quite reasonable. The tax will be levied at 5% of the Taxable Annual Value (TAV) of residential properties and 6% of TAV for non-residential properties. In fact, the tax rates in Jammu and Kashmir are some of the lowest in the country, almost half that of Himachal and one-fourth to one-sixth of other progressive states like Gujarat, Maharashtra, Karnataka, and Delhi.

The tax system is also progressive and takes into account various factors such as the age of the property, the use type, and the construction type, among others. Residential houses up to a build-up area of 1000 sqft have been exempted, and smaller assets are being taxed at lower rates. The taxable annual value has been linked to circle rates, meaning that the lower the circle rate, the lower the tax liability.

For instance, an owner of a residential bungalow over a kanal of land in a posh colony of Gandhinagar in Jammu and Raj Bagh in Srinagar, with an asset value of more than five crores, will be required to pay only Rs 500/- per month, which is a reasonable amount. Similarly, apartment owners may be charged Rs 100/- or even less per month. It is important to note that all places of worship, including temples, masjids, gurudwaras, churches, ziarats, etc., are exempt from paying property tax.

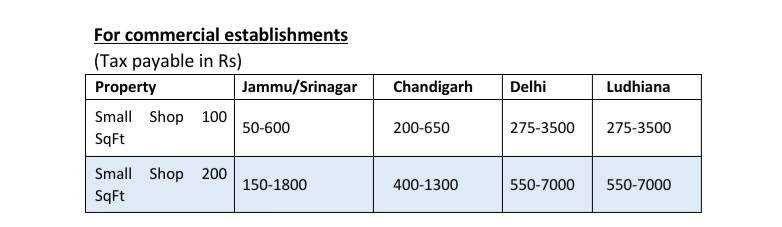

Similarly, small commercial establishments especially shops upto the size of 100 sqft and 200 sqft are also provide relief with very minimal Tax implications. It is pertinent to mention that most of the shops especially in neighbourhood areas and old markets fall into this category.

The newly introduced Property Tax policy in Jammu and Kashmir is aimed at generating revenue for better municipal services while keeping the tax implications on residents to a minimum. As the tax will be levied annually and can be paid in two installments, it is not expected to be a burden on the common citizen. In fact, early submission of Property Tax can even lead to a 10% rebate, as per the Act.

The implementation of this policy is expected to attract more investment and encourage more people to set up businesses in J&K, as better municipal services will be provided with the revenue generated from property taxes. The funds will be utilized for improving infrastructure and enhancing the quality and level of services provided by Municipal bodies. J&K is witnessing a new urban renaissance, and it is important for all residents to be a part of it.

[…] Wasif hails from a middle-class family, where his father is a bus conductor employed by the J&K State Road Transport Corporation. Despite limited financial resources, Wasif pursued his passion with […]